Biometric Payments: The Next Big Thing in UK Retail?

The retail industry in the UK has undergone a significant transformation in recent years, with digital payments becoming the norm. As technology advances, the future of retail transactions is shifting toward biometric payments a method that uses unique physical characteristics such as fingerprints, facial recognition, and even iris scanning to authenticate transactions. This innovative payment technology is gaining traction worldwide and is poised to revolutionize the UK retail sector. But how does biometric payment work, and what are the benefits and challenges of adopting it? Let’s explore this next big thing in UK retail.

What Are Biometric Payments?

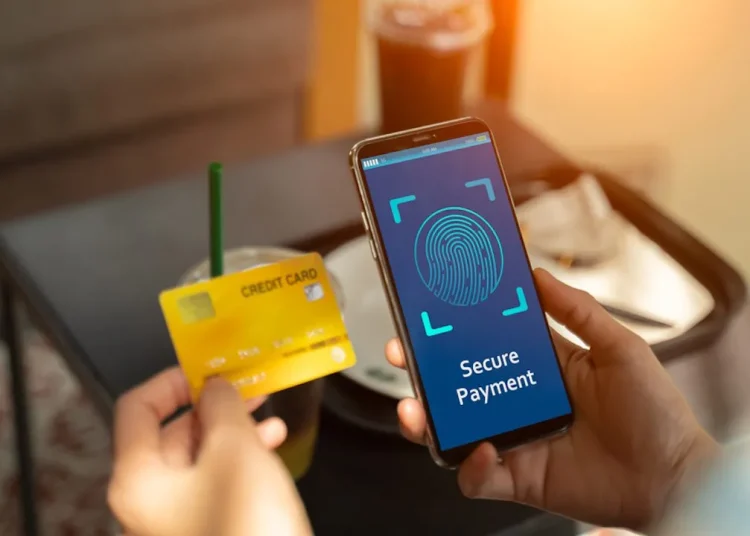

Biometric payments are transactions authenticated using biological features instead of traditional methods like PINs, passwords, or physical cards. This technology leverages fingerprint scans, facial recognition, voice authentication, and even vein pattern recognition to verify a customer’s identity and authorize payments seamlessly. With built-in security layers, biometric authentication offers a frictionless, secure, and convenient alternative to conventional payment methods.

How Biometric Payments Work in Retail

Biometric payment systems integrate with existing Point of Sale (POS) systems and banking networks to provide a streamlined customer experience. Here’s how a typical transaction works:

Enrollment : Customers register their biometric data (fingerprints, facial scan, or iris recognition) with their bank or payment provider.

Authentication : When making a payment, customers use their biometric feature at the checkout terminal instead of entering a PIN or using a card.

Transaction Approval : The system verifies the biometric data, matches it with the stored credentials, and processes the transaction within seconds.

Why Biometric Payments Are Gaining Popularity in the UK

The UK is witnessing rapid adoption of contactless and digital payment methods, making biometric payments a natural evolution. Several factors contribute to their increasing popularity:

Enhanced Security: Unlike PINs and passwords, which can be forgotten or stolen, biometric identifiers are unique to individuals, reducing the risk of fraud.

Faster Transactions: Biometric authentication eliminates the need for manual PIN entry, making transactions smoother and faster, especially in high-traffic retail environments.

Convenience for Consumers: Customers no longer need to carry wallets, cards, or remember passwords. A simple scan of their fingerprint or face is enough to complete a transaction.

Growing Consumer Trust: As biometric security becomes commonplace in smartphones and banking apps, consumers are more comfortable using this technology for payments.

Industries in the UK Adopting Biometric Payments

Biometric payments are expanding across various retail sectors in the UK. Key industries integrating this technology include:

Supermarkets & Grocery Stores: Retail giants like Tesco and Sainsbury’s are exploring biometric checkouts to speed up the payment process and enhance customer convenience.

Fast Food & Restaurants: McDonald’s and other quick-service restaurants are testing biometric kiosks that allow customers to pay without using cards or cash.

Fashion & Luxury Retail: High-end brands are adopting biometric authentication for personalized, seamless shopping experiences.

Public Transport & Travel: London’s public transport system, already a leader in contactless payments, is exploring biometric-enabled ticketing for a smoother commuter experience.

The Challenges of Biometric Payment Adoption

While biometric payments offer numerous advantages, they also present challenges that retailers and consumers must consider:

Privacy Concerns: Consumers may be hesitant to share biometric data due to fears of data breaches and misuse.

Data Security Risks: Unlike passwords, biometric data is permanent. If compromised, it cannot be reset like a PIN or password.

Infrastructure Costs: Retailers must invest in specialized biometric-enabled payment terminals and integrate them with existing systems.

Regulatory Compliance: The use of biometric data is subject to strict data protection regulations like the UK’s GDPR, requiring businesses to implement stringent security measures.

The Future of Biometric Payments in the UK

Despite the challenges, the future of biometric payments in the UK looks promising. With advancements in AI-driven authentication and blockchain-based security, biometric transactions will become more secure and widely accepted.

Expansion Beyond Retail: Biometric payments will likely extend beyond stores and supermarkets into hospitality, healthcare, and entertainment industries.

Integration with Mobile Banking: Banks and fintech firms will incorporate biometrics into mobile payment solutions, further enhancing security and user experience.

AI & Machine Learning Improvements: AI-powered fraud detection will strengthen biometric payment security, reducing potential risks.

Conclusion

Biometric payments are set to revolutionize the UK retail industry, offering a seamless, secure, and efficient alternative to traditional payment methods. As businesses and consumers increasingly embrace digital transactions, the adoption of biometric authentication will accelerate, making it a mainstream payment option in the coming years. Retailers who invest in this technology early will gain a competitive advantage, providing their customers with the future of payment today.

As technology evolves and regulatory frameworks strengthen, biometric payments will likely become the norm in UK retail. The question is not if biometric payments will take over but when. Retailers must prepare to embrace this shift and leverage biometric technology to enhance customer experience and business growth.